State of the Technology Staffing Industry in the First Half of 2022

Amidst the mixed economic and employment messages, the industry remains strong

These are indeed strange times in the technology staffing industry as we are inundated with mixed signals. While inflation is up and there is economic uncertainty with rising interest rates and the threat of recession, demand for talent remains strong, with IT and Engineering unemployment rates at historically low levels.

To provide more perspective on these contradictory market signals, TechServe Alliance CEO Mark Roberts and Jim Janesky, senior advisor with the Corporate Advisory Group at Peapack Private Investment Banking offered their insights in a recent webinar presentation. In addition to laying out the economic landscape on insights drawn from TechServe Alliance’s annual benchmarking report, they share their thoughts on the future prospects of the industry. The bottom line is that despite the economic uncertainties, the market for IT and engineering staffing is still going strong.

Where We Are Now?

The Employment Landscape

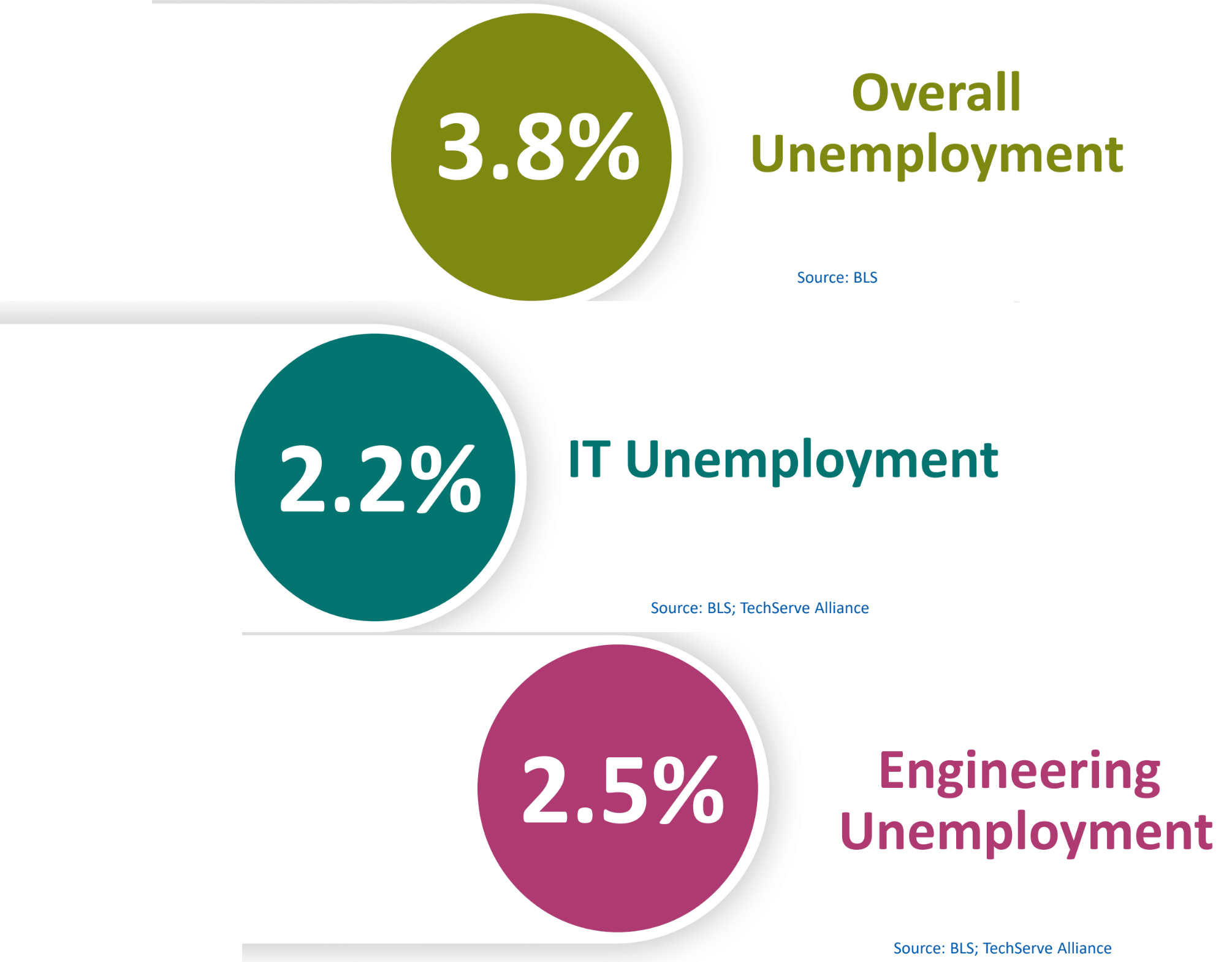

While the overall unemployment rate stands at 3.8% – at or near full employment, unemployment in IT and engineering skill sets is even lower.

In the IT and Engineering staffing industry is still faced with the ‘good’ problem, as Roberts puts it: high demand for talent, with low supply. The overall IT unemployment rate is currently 2.2%.

Quarterly Unemployment Rates

When looking at specific skill sets, computer programmers and computer support specialists had unemployment rates of 1.5% and 2.8%, respectively.

IT UNEMPLOYMENTBY SKILL SETS |

|

|---|---|

| Computer Programmers | 1.5% |

| Web Developers | 2.2% |

| Computer Support Specialists | 2.8% |

|

Overall engineering unemployment is similarly at extraordinarily low levels at 2.5%. For specific skill sets, unemployment rates for Civil Engineers was 3.3%, Industrial Engineers 1.4%, and Mechanical, Electrical/Electronic, and Architectural Engineers, and Engineering Managers, less than 1%.

ENGINEERING UNEMPLOYMENTBY SKILL SETS |

|

|---|---|

| Architectural/Engineering Managers | 0.2% |

| Civil Engineers | 3.3% |

| Industrial Engineers | 1.4% |

| Electrical & Electronic Engineers | 0.4% |

| Mechanical Engineers | 0.5% |

|

On a monthly basis, TechServe tracks IT and engineering employment. Roberts observed that IT employment has essentially flattened out since recovering from the dip triggered by the pandemic. “It is purely a reflection of inadequate supply, not one of demand.”

“Share this data with your clients,” Roberts urges. “It can help them understand why they need to move quickly with decision making, to not be unreasonable with billing rates, and to not hold out for that ‘perfect’ candidate.”

The Economic Backdrop

The Conference Board has a great deal of difficulty predicting GDP in volatile times, both up and down, noted Janesky. However, there is no doubt that the US economy is slowing. The Conference Board now predicts GDP growth of only 2.3% – significantly slower than their last forecast – due to factors including the war in Ukraine and unexpectedly high inflation.

Indeed, the Federal Reserve Board has now stated that high inflation rates are no longer considered ‘transitory’. “The Fed had really downplayed the risk of an inflation spike, and they’ve in effect done a mea culpa, that they had it wrong,” Roberts says. “This has pushed the Fed into having to tighten, raising interest rates with more hikes to come.”

The Consumer Price Index (CPI) has increased 8.6% year over year, and while energy costs drove much of this increase with a jump of 34.6% – the largest since 2005 – food prices were also up by over 10%.

Adding to the uncertainty are conflicting dynamics in areas which have a direct impact on the engineering segment. Oil and gas prices are at record highs, largely due to low production and the war, engineering spend hasn’t followed. On Infrastructure, while government spending is up, it has moderated. The $1.2 trillion infrastructure spending bill is in play, but won’t directly affect the market until late 2022.

In the manufacturing sector, there is good growth in heavy equipment, automotive and appliances. While high-tech manufacturing is also showing a fair amount of growth, it is unclear on the future prospects of chip manufacturing in the US. There is currently solid demand for both commodity and specialty chemicals, but demand for the latter would suffer if there is a recession.

Public Policy Impacting the Industry

On the public policy front, TechServe Alliance is actively watching and engaged on legislative and regulatory developments that affect our industry. As the Biden administration has generally advocated for positions that are favored by unions and employee advocates, we are closely monitoring potential changes in a number of policy areas that can impact the industry. One of the major areas the business community is watching closely are potential changes to the overtime rules that are expected later this year. TechServe remains engaged on representing industry interests on overtime exemptions applicable to computer professionals as well as other members of the internal team. In addition to overtime, the Administration is looking to rewrite the current definition of independent contractor—a significant issue for the industry. Having previously weighed in on the issue, we will remain involved in any future rulemaking process. Another area TechServe is closely watching is the administration’s hostility toward non-compete clauses—an area the FTC is reviewing.

“Immigration is so politically fraught, we are not expecting to see much change given that we’re in an election year,” Roberts notes. “One area within immigration we are particularly focused on is the definition of the employee-employer relationship in the context of eligibility for visa sponsorship. This definition has been used to restrict staffing firms’ access to H-1Bs in the past.” On a positive note, H-1B denials remain far lower than those seen under the previous administration.

“I encourage folks interested in regulatory and legislative developments to contact us,” Roberts says. “TechServe continues to monitor developments, making sure the industry’s interests are being looked after, on Capitol Hill and elsewhere.”

How We Are Doing: Industry Performance

The TechServe Alliance 2022 Operating Practices Report (OPR) provides unique insights into how companies in the technology staffing sector are performing, amidst the rapidly-evolving environment.

Despite a number of challenges, the picture for the technology staffing sector has been bright.

- The median technology staffing firm saw 18% year-over-year growth

- Median gross margins improved to 27.6% with high-profit firms posting gross margins of 32%

- The median EBITDA was 6.7%, a significant improvement

While controlling operating expenses is often the primary driver of higher profitability in down markets, achieving higher gross margins is the major contributor to achieving enhanced profitability when demand is strong. Technology staffing firms have been performing extraordinarily well on a bottom-line basis. While net profitability has historically hovered around 4%, the median firm most recently delivered 6.3% with high-profit firms posting 11.7%.

Key Findings from the 2022 Operating Practices Report (OPR)

| Typical Tech Staffing Firms | High-Profit Tech Staffing Firms | |

|---|---|---|

| Gross margins | 27.6% | 32% |

| Operating expenses | 21.3 | 20.3 |

| Profits before taxes | 6.3% | 11.7% |

More Highlights and Trends from OPR

Direct hire. The OPR shows a significant increase in the percentage of gross revenue attributable to direct hire: 5.9% for typical firms, and 10% for those in the high-profit group. There is a clear correlation between higher profitability and the increase in direct higher revenue.

Remote and hybrid work. Prior to the pandemic, remote and hybrid work for the median firm was 15-20% for internal employees. That number jumped to 90-95% during the peak of the pandemic, and it was at similarly high levels as of the last year. The percentage of consultants working remotely was 25% for the typical firm. Rising to 80-90% during the height of the pandemic, it was most recently in the range of 70-80%.

The takeaway: Remote and hybrid work is here to stay for many internal teams and consultants.

Once again, Roberts urges those in the staffing industry to use this data to help clients be more competitive. “As we know, these days it’s not just about pay rate. Allowing employees to work fully remote or hybrid can be a critical factor.”

M&A activity. While multiples for public firms have declined, demand for acquisitions by buyers in the private market remains strong. TechServe Alliance Services Corp. launched the M&A Marketplace Program to create a market for buyers and sellers of technology staffing firms. There has been an extraordinary response to the M&A Marketplace, with three transactions closed and many others in the pipeline. This has given Roberts a unique vantage point on the state of the M&A market. Both Roberts and Janesky noted that multiples for high-performing technology staffing firms remain attractive.

Where We Are Going: Industry and Economic Forecast

While there is a great deal of uncertainty, Roberts and Janesky sum up the key takeaways on both the economic and staffing industry fronts as they see them now.

The relatively solid economic backdrop before the decline triggered by the pandemic was followed by a swift and dramatic recovery we’ve seen over the past year. Future economic growth is likely to not be as robust. According to Janesky, “We’re not ready to push the recession button yet, but the risks have certainly increased.”

The biggest risk factor may in fact be the fear of a recession. “Will a recession be self-fulfilling?” Janesky asks. “When consumers and corporate executives hear about the risk of recession, consumers pull back on spending. Businesses become more cautious about spending. That could lead to a self-fulfilling recession; it’s happened in the past.”

Despite the economy being on relatively uncertain ground, it’s important to remember that the IT and engineering staffing markets generally outperform both GDP and the overall staffing industry. The IT staffing market remains strong, albeit with pockets of slower growth. The sector is poised to perform better than any other except healthcare and life sciences. This points to 2022 potentially being a record year. Given this strength, we are projecting IT and engineering staffing industry up 11% and 9%, respectively. Even if we are unable to avoid a recession, the IT and engineering staffing market typically emerges quickly. Regardless of what plays out over the next year, there is every reason to be bullish on the future of the technology staffing industry.

Roberts and Janesky covered a lot more ground in their presentation, and the full recording can be viewed here. And if you haven’t already, don’t miss the 2022 Operating Practices Report, full of additional data and industry insights.