Benefits Toolkit: Level Funded Health Plans-Are these right for your company?

Introduction

Rising health care costs continue to frustrate many employers, especially those with a workforce that is not overusing health care or generating high cost claims. Although many large employers have switched to self-insured health plans as a way to lower health care costs, small to midsized employers may be hesitant to leave the financial predictability of a fully insured health plan for the uncertainty of self-insuring. With self-insured health plans, employers pay claims out of pocket as they are processed, and claim amounts can vary widely from month to month, making it difficult for an employer to budget for health care expenses. Due to this financial uncertainty, self insuring may not be an option for employers who do not have a steady cash flow or substantial cash reserves.

Level funded health plans are a relatively new type of funding approach for small to midsized employers. They combine many of the benefits of a self- insured health plan—namely, potential cost savings, flexibility with plan design and access to useful claims data—with the financial security of a fully insured health plan.

With level funding, an employer pays a fixed monthly fee to an insurance carrier or third-party administrator (TPA) to cover estimated health care claims for the year, stop loss insurance and plan administration expenses. If an employer’s health care claims for the year are lower than estimated, the employer may receive a refund of all—or a portion of—the surplus from the carrier or TPA.

Although level funded health plans have many advantages, they are not the right fit for every employer, especially those whose employees are older or have chronic illnesses. Employers interested in level funding will need to closely analyze the advantages and disadvantages before making a final decision.

This toolkit aims to help employers’ decision-making and serves as a guide to level funded health plans. It explains what level funding is, discusses how it differs from fully insured and self-insured health plans, and highlights its growing popularity. This toolkit also summarizes the advantages and disadvantages of level funding to help employers determine if this type of plan design is right for them.

Background

This section (1) provides a quick overview of level funded health plans; (2) highlights the growing popularity of this type of plan funding; and (3) compares the three types of plan funding designs available to employers: fully insured, self-insured and level funded.

Level Funded Health Plans: Quick Overview

Level funding is a relatively new approach that can help employers lower their health care expenses while still providing employees with comprehensive health plan coverage and a strong provider network. Level funded health plans are typically offered by insurance carriers and TPAs to small and midsized employers, with specific size requirements defined by each carrier or TPA. These plans combine the cost savings and flexibility of a self-insured health plan with the financial predictability of a fully insured health plan. This approach often appeals to employers who want to lower their monthly health care expenses but are hesitant to move to a self-insured plan or are too small to consider self-insuring.

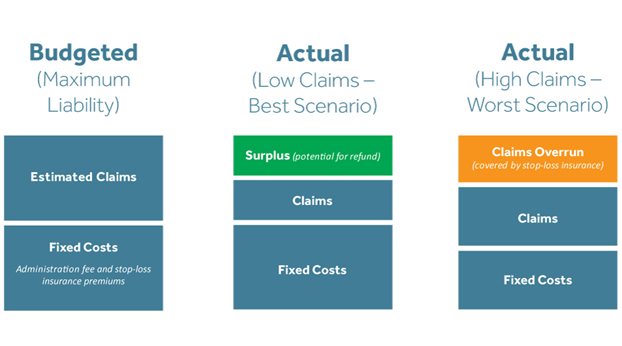

Under a level funded health plan, the employer pays a “level” fee each month to an insurance carrier or TPA. This fee, which is set for a 12-month period, is partially based on the health status of the employer’s own group. It covers the estimated annual cost for benefits, a premium for stop-loss protection and an administrative fee. The carrier or TPA handles the day-to-day administration of the plan, including processing and paying claims and providing customer service resources for covered employees and their dependents.

If, during a year, actual claim costs are higher than expected, the employer’s stop-loss insurance will cover them and the employer won’t be required to pay more at the end of the year. However, if actual claim costs are lower than estimated for the year, the insurance carrier or TPA may refund the surplus amount (or a portion of the surplus amount) to the employer, depending on the contract’s terms.

The main advantages of level funding include:

Although there are many possible benefits to level funding, there are also some drawbacks to this type of plan design; it is not the right fit for every employer. Companies with employees who are older, have major illnesses (such as cancer, diabetes or arthritis) or take expensive medications may not see a cost savings by moving from a fully insured health plan to a level funded one. Also, many carriers or TPAs only offer these plans to employers of a certain size, which may prohibit other employers from making the switch to level funding.

Additionally, employers that move from a fully insured plan to a level funded plan will take on more compliance responsibilities under federal law, such as the requirement to pay certain ACA fees, and may need to redesign their plan’s rules to comply with nondiscrimination requirements.

Growing Popularity of Level Funding

As health plan premiums continue to rise, many employers are struggling to provide a health plan that meets their workforce’s needs at a manageable cost.

Health Insurance Premiums Keep Increasing

According to the Kaiser Family Foundation’s Employer Health Benefits 2021 Annual Survey, the average premium for family coverage has increased 22% over the last five years and 47% over the last ten years. During 2021, the average annual premiums for employer sponsored health insurance were $7,739 for single coverage and $22,221 for family coverage with employers contributing, on average, 83% of the premium for single coverage and 72% of the premium for family coverage.

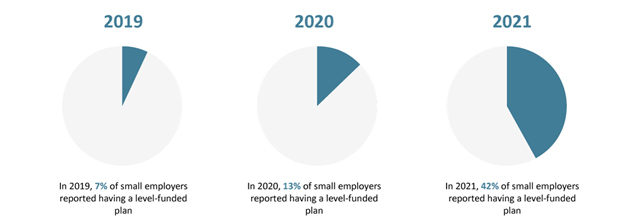

Level funding has become a popular option for small and midsized employers. More insurance carriers and TPAs are offering level funding as a way to save on premium costs while avoiding the risk of a self-insured plan. According to the Kaiser annual survey for 2021, 42% of small employers (those with fewer than 200 workers) reported having a level funded health plan, a much higher percentage than in the previous two years. Consider this recent increase in popularity:

Note that level funded health plans are a relatively new and complex arrangement. The Kaiser annual survey cautions that some small employers included in the survey may not be entirely certain whether their health plan is fully insured, self-insured or level funded.

Comparison of Plan Funding Options

Employers typically have three options when funding their health plan: fully insured, self-insured and level funded. Key concerns that drive an employer’s decision to select one of these options include:

- Employer size

- Budgeting and cash flow (or cash reserves)

- Flexibility with plan design

- Health status of the workforce

Fully Insured Health Plans

A fully insured health plan moves most of the financial risk away from the employer and places it on the insurance carrier. However, in turn, the cost of the plan is usually higher for employers. The employer pays a monthly premium to the insurance carrier. The premium rate is typically fixed for a 12-month period and based on a number of different factors, including the ACA’s modified community rating requirements for employers in the small group market (generally, employers with 50 or fewer employees).

An employer’s liability for health care expenses is limited to their monthly insurance premiums—it is not required to pay more to their carrier if their workforce has unexpectedly high claim costs for the year. However, the insurance carrier will not give any money back to the employer if the employer’s group has lower than expected claim costs.

In terms of plan design, fully insured health plans are subject to state taxes and insurance laws, including state laws that mandate coverage of certain benefits and state continuation coverage laws (or “mini-COBRA” laws). Also, fully insured health plans for employers with 50 or fewer employees are subject to the ACA’s essential health benefits (EHB) requirement, which requires these plans to cover a core set of items and services.

Self-insured Health Plans

A self-insured health plan places most of the financial risk on the employer. Instead of paying fixed premiums to an insurance company—which, in turn, assumes the financial risk of paying claims—the employer pays for medical claims out of pocket as they are processed throughout the year. One main reason employers choose to self-insure is to save money by not paying monthly premiums, especially if the employer has a healthy workforce that is not incurring high health claims.

However, self-insuring can expose an employer to a much larger risk in the event that more claims than expected must be paid. After all, a self-insured plan requires an employer to pay claims as they are approved, which may mean paying a small amount one month and a large amount the next. This financial risk makes self-insuring difficult for very small employers and those with unsteady cash flow or small cash reserves. Employers with self-insured plans usually purchase stop-loss insurance to limit their overall risk, although stop-loss insurance doesn’t help an employer when it must pay a cluster of claims all at once.

In addition to their potential cost savings, self-insured health plans often appeal to employers because they offer more design flexibility than fully insured health plans. Self-insured plans are not subject to state insurance mandates or mini-COBRA laws. They are also not subject to the ACA’s EHB coverage requirements. However, there are additional compliance responsibilities for employers with self-insured plans, such as the requirement to pay certain ACA fees and to structure their plans in a way that does not discriminate in favor of highly compensated employees.

Level Funded Health Plans

A level funded health plan combines the potential cost savings and design flexibility of a self-insured health plan with the low financial risk of a fully insured health plan. Typically, these plans are only offered to small and midsized employers, with specific size requirements determined by the carrier or TPA.

With a level funded plan, the employer pays a fixed monthly amount to a carrier or TPA, which covers anticipated claim costs, stop-loss insurance and a fee for plan administration. If claim costs are lower than expected at the end of the year, the employer may receive a refund for all (or a portion) of the surplus. However, if claims are higher than expected for the year, the stop-loss insurance will cover the excess, and the employer won’t be required to pay more. Because the monthly premium cost is based partly on the health of the employer’s workforce, employers with older employees or employees with chronic illnesses may not see cost savings with this type of design.

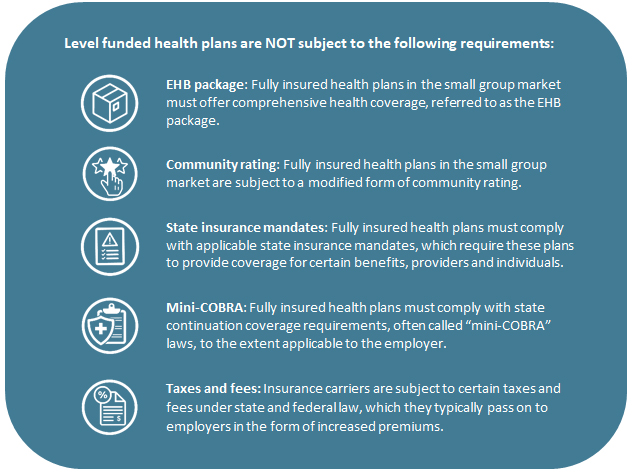

Level funded plans are considered a type of self-funded plan for compliance purposes, which means these plans are not subject to state insurance requirements, such as state benefit mandates and mini-COBRA laws. Level funded plans also avoid the ACA’s modified community rating and EHB coverage requirements that apply to fully insured plans in the small group market. However, employers with level funded plans have additional compliance obligations, such as paying certain ACA fees and satisfying federal requirements that prohibit plan designs that discriminate in favor of highly compensated employees.

How Level Funding Works

The Basics

Level funding may offer small and midsized employers a way to lower their monthly health care expenses while still providing a health plan that meets their workforce’s needs. Level funding is an appealing option because it provides the financial predictability of a fully insured health plan but allows employers to share in cost saving—similar to a self-insured plan—and have greater flexibility in plan design and access to claims data.

Each month, employers with level funded plans pay a “level” fee to an insurance carrier or TPA that includes three components:

- An estimated amount for the maximum claim liability for the year (usually based on the health status of the employer’s group)

- A fee for administering the health plan (for example, claims processing, billing and customer service)

- A premium for stop-loss insurance coverage to protect the employer against the financial impact of large claims and high utilization

The monthly fee amount is determined by the carrier or TPA and remains fixed (or level) for a 12-month period. Similar to a fully insured health plan, the employer pays this fee each month, regardless of claims activity. As with other types of health plans, employers typically collect some of this monthly cost from employees through pre-tax payroll deductions.

The carrier or TPA pays claims throughout the year from the claims account funded by the employer’s monthly payments. At the end of the plan year, if actual claims are less than projected, the employer may be entitled to a refund of all (or a portion) of the surplus from the carrier, depending on the contract terms. If actual claims exceed projections at the end of the plan year, stop-loss insurance protects the employer from unexpected costs.

Note that level funded plans typically have a designated period after the end of the year for processing and paying claims incurred during the year, called a runout period. The employer’s monthly payments will cover claims that are paid during the runout period—no extra funding is required from the employer to pay these claims. The carrier or TPA will determine if there is a surplus in the employer’s claim account after the runout period.

Level funding is a relatively new approach. Level funding contracts with an insurance carrier or TPA will likely include some unfamiliar concepts and obligations—for example, rules for handling any surplus refunds. Employers should exercise caution and work with their advisors to ensure they understand the contractual terms before entering into a level funding agreement.

Key Components

Lower Health Care Costs

An employer’s monthly cost may be lower with a level funded health plan because fees are based on the employer’s own group and not subject to the ACA’s modified community rating requirement. This can be a significant financial advantage for employers with healthy workforces that are not overusing health care. Also, level funded plans are not subject to state insurance mandates and state premium taxes, which can help lower monthly costs.

However, employers with employees who are older, have major illnesses or take expensive medications may not see cost savings with level funding. If an employer’s claims are more than expected, there may be a significant increase in the monthly fee for the next year, and it may be difficult for the employer to secure stop-loss insurance.

Refunds

A key advantage to level funding is the potential for a refund if the plan’s actual claims are lower than expected at the end of the year. There are a variety of carriers and TPAs offering level funded plans, and each one typically has its own approach to handling claims surpluses. Employers should carefully review level funding contracts to understand how each carrier and TPA handles claim money that is left over at the end of the year.

Employers should select level funded providers that have an employer-friendly approach to using surpluses. Such an approach may include refunding the entire surplus to the employer or refunding most of the surplus to the employer and keeping the rest of the surplus to offset the employer’s costs for the next plan year. Employers should be cautious about entering into contracts allowing the carrier or TPA to retain a significant percentage of the surplus for itself or requiring the employer to renew the contract to receive the surplus.

In addition, employers who receive surplus refunds need to consider the Employee Retirement Income Security Act’s (ERISA) exclusive benefit rule and should not assume that they can simply use the entire refund for their own purposes. Generally, ERISA requires that plan assets be used exclusively for the benefit of the plan’s participants and beneficiaries, not for the employer’s own purposes. If employees pay for any portion of the monthly fee to the carrier or TPA—for example, through pre-tax payroll deductions—a portion of the rebate is considered a plan asset that can only be used for the benefit of the plan’s participants and beneficiaries.

Design Flexibility and Compliance

Level funding can give employers more flexibility in designing their health plan’s coverage rules and benefits. Most carriers and TPAs that offer level funding provide small and midsized employers with various plan designs to choose from, such as high deductible health plans that are compatible with health savings accounts (HSAs), network-only options and traditional Preferred Provider Organization (PPO) plans.

Because level funded plans are considered self-insured plans for compliance purposes, they are not subject to state insurance laws regarding mandated benefits or the federal EHB coverage requirements for employers in the small group market. This can allow for more customization, depending on the carrier’s or TPA’s offerings.

Although employers may have more design flexibility with a level funded plan, these plans trigger additional compliance requirements for employers to consider. Unlike a fully insured health plan where the carrier often takes the lead on compliance requirements, employers with level funded plans will be responsible for additional fees, reporting and coverage requirements.

Transparency

Unlike most fully insured plans, level funded plans typically provide employers with periodic utilization reports to help them better understand how their employees are using health care benefits. This utilization information can help employers identify behavior that drives up claim costs—such as frequent emergency room visits, low utilization of generic drugs and hesitancy to use virtual care—and provide employees with education to change these behaviors. Because level funded plans typically deliver this information throughout the year, employers can address problematic trends in real-time, which can increase the likelihood that an employer will have a claims surplus at the end of the year.

Stop-loss Insurance

A key component of level funded plans is stop-loss insurance. The premiums for stop-loss insurance are included in the monthly fee the employer pays to the carrier or TPA. The purpose of this coverage is to protect an employer from the financial impact of unexpected health care claims.

With a level funded health plan, claims are first paid from the claims account set up by the carrier or TPA, which is also funded by the employer’s level monthly fee payment. If a specific claim (or claims in the aggregate) exceeds a specific amount—called the attachment point—the stop-loss insurance starts paying. Stop-loss insurance typically provides protections in two forms:

- Specific stop-loss—Also referred to as individual stop-loss, it protects a plan against individual catastrophic claim occurrences. This type of stop-loss coverage shifts responsibility for a claim to the insurer once that claim exceeds a certain dollar amount.

- Aggregate stop-loss—This limits a plan’s financial exposure for the entire plan year and protects against abnormal claim frequency across the entire group of individuals. This type of stop-loss coverage protects the employer against high health plan claims cumulatively (that is, the total sum of claims for the entire group rather than an individual claim).

Compliance Requirements for Level Funded Plans

While level funded health plans can provide more flexibility and lower monthly costs than fully insured plans, they come with additional compliance requirements. Level funded health plans are generally considered self-insured for compliance purposes, meaning the compliance requirements that apply to self-insured health plans under federal law also apply to employers with level funded health plans. Employers who move from a fully insured health plan to a level funded plan should understand they are taking on additional compliance responsibilities, as described in the callout box below.

However, note that there are some compliance requirements that apply to fully insured health plans that do NOT apply to level funded health plans. Employers who move to level funding may be able to save on monthly expenses in part because these requirements do not apply.

Nondiscrimination Rules

Self-insured health plans, including level funded health plans, are subject to nondiscrimination rules that do not apply to fully insured health plans. Internal Revenue Code (Code) Section 105(h) contains nondiscrimination rules for self-insured health plans. Employers moving from a fully insured health plan to level funding should review their plan designs and determine if they will need to make any changes—for example, changing the plan’s eligibility rules—to comply with Code Section 105(h).

Under Code Section 105(h), level funded health plans cannot discriminate in favor of highly compensated individuals (HCIs) with respect to eligibility or benefits. In general, an HCI is an employee who is among the highest-paid 25% of all the employer’s employees. The eligibility test looks at whether a sufficient number of non-HCIs benefit under a self-insured health plan. The benefits test analyzes whether the plan provides HCIs with better benefits, either in terms of how the plan is designed or how it operates.

In general, a level funded health plan will not have problems passing the Section 105(h) nondiscrimination tests when the employer treats all of its employees the same for purposes of health plan coverage (for example, the plan’s eligibility rules and benefits are the same for all employees). This is the case even if HCIs use the plan’s benefits more than non-HCIs. However, treating HCIs more favorably—either in terms of plan design or operation—may make it difficult for a health plan to pass the applicable nondiscrimination tests.

ACA: Health Coverage Reporting

Employers with level funded health plans must file an annual return with the IRS reporting information for each individual provided with coverage. Related statements must also be provided to individuals. This reporting requirement is found in Code Section 6055 and is intended to help the IRS determine if any individuals are eligible for tax credits to buy individual insurance coverage.

Applicable large employers (ALEs)—those with at least 50 full-time employees, including full-time equivalents—have been subject to similar reporting requirements under Code Section 6056 for many years, regardless of whether their health plan is fully insured, self-insured or level funded. However, this health coverage reporting will be a new compliance requirement for small non-ALEs that move from a fully insured plan to a level funded one.

Non-ALEs with level funded health plans will generally file Forms 1094-B (a transmittal) and 1095-B (an information return) with the IRS no later than Feb. 28 of each year (or March 31 if filing electronically). Statements must be provided to covered individuals by Jan. 31 of each year, although the IRS has extended this annual deadline for an additional 30 days. Reporting extensions are available for employers that need extra time.

ACA: PCORI Fees

The ACA imposes a fee on health insurance issuers and employers with self-insured health plans (including level funded plans) to help fund the Patient-Centered Outcomes Research Institute (PCORI). The fee, called the PCORI fee, is calculated based on the average number of lives covered under the policy or plan. For example, for plan years ending on or after Oct. 1, 2022, and before Oct. 1, 2023, the PCORI fee is $3.00 times the average number of covered lives. Employers that move from a fully insured health plan to a level funded plan should understand that they will be responsible for reporting and paying this fee. The PCORI fee is filed using IRS Form 720, Quarterly Federal Excise Tax Return. Although Form 720 is a quarterly return, it must be filed annually only for PCORI fees by July 31.

Use of Plan Assets (ERISA): Surplus Refunds

Employers with level funded health plans should be aware of ERISA’s fiduciary rules regarding the use of plan assets in the event they receive a surplus refund from their carrier or TPA. Almost all employer-sponsored group health plans are subject to ERISA, although there are narrow exceptions for governmental and church employers. As a general rule, ERISA requires that plan assets be used exclusively for the benefit of the plan’s participants and beneficiaries, not for the employer’s own purposes.

Employers with level funded health plans who receive surplus refunds need to consider ERISA’s exclusive benefit rule and should not assume they can simply use the entire refund for their own purposes.

In general, if employees pay for any portion of the monthly fee to the carrier or TPA—for example, through pre-tax payroll deductions—a portion of the rebate is considered a plan asset that can only be used for the benefit of the plan’s participants and beneficiaries. To comply with ERISA, an employer could, for example, distribute the plan asset portion of the rebate to participants under a reasonable and fair allocation method or apply the rebate to reduce future employee premium payments. Employers cannot, however, retain the plan asset portion of the rebate for their own purposes or apply it to other benefit programs.

HIPAA Privacy and Security

The Health Insurance Portability and Accountability Act (HIPAA) is a broad federal law that includes rules for protecting the privacy and security of certain health information, which is called protected health information (PHI). Most employers who sponsor fully insured health plans have minimal compliance responsibilities under the HIPAA Privacy and Security Rules because they do not have access to PHI from their insurance carriers. In this situation, almost all of the HIPAA compliance requirements fall on the carrier, not the employer. However, this is not an option for self-insured health plans, including level funded plans.

Employers with level funded health plans must comply with the wide range of HIPAA Privacy and Security requirements, including providing a privacy notice, conducting HIPAA training, implementing security safeguards and adopting certain policies and procedures. Employers with level funded plans should consult with their carriers and TPAs to see what help and resources are available to satisfy these HIPAA requirements.

Pros and Cons of Level Funding

While level funding can offer several advantages, especially for employers who are paying increasingly high premiums for fully insured coverage, this approach also has some drawbacks. The advantages and disadvantages of level funding for a specific company will depend on that organization’s own circumstances, including the health status of its workforce. Employers thinking about moving to a level funding plan should consider the following pros and cons of this approach.

Advantages of Level Funding

The primary reasons for implementing a level funded health plan include:

Lower Monthly Costs

Employers who move from fully insured health plans to level funding may reduce their monthly health care expenses, especially those with employees who do not have chronic illnesses or tend to overuse health care benefits. Unlike fully insured plans, the monthly fee for level funded plans is typically based on the company’s own employee group and not the broader community, which can result in lower overall risk and costs. Also, the monthly fee does not include state premium taxes and fees that typically apply to the monthly premium for fully insured plans.

Predictable Expenses/Low Risk

With level funding, an employer pays the same monthly fee throughout the 12-month period, similar to a fully insured health plan. This is different from a self-insured plan, where an employer’s health care expenses may vary widely from month to month because claims must be paid out of pocket as they are processed. In a level funded plan, even if claims exceed expectations, the employer is not required to pay more due to the plan’s built-in stop-loss insurance. This predictability and low risk make level funding appealing to employers who want predictable budgets for their health care expenses, including those without steady cash flow or significant cash reserves.

Surplus Refunds

If an employer’s health claims are lower than expected for a year, the employer may receive a refund of all or a portion of the surplus (depending on the specific contract terms). This is an advantage over fully insured health plans, where the carrier keeps the employer’s monthly premium payments even if there is low health care utilization for the year.

Comprehensive Coverage/National Networks

Although level funding is a relatively new approach for employer-sponsored health plans, it has been gaining popularity. Many large carriers and TPAs offer level funding options for small and midsized employers. These carriers and TPAs often provide a variety of plan designs for medical and prescription drug benefits—such as HSA-compatible plans, network-only options and traditional PPO plans—with national provider networks.

Plan Design Flexibility

Employers with level funded plans may have more flexibility with their plan’s benefits and coverage rules because, unlike fully insured health plans, level funded plans are not subject to state insurance mandates. Also, level funded plans are not subject to the ACA’s requirement to provide comprehensive coverage (EHB package) that applies to fully insured employers in the small group market.

Actionable Utilization Information

Many level funding arrangements will provide employers with utilization reports describing how employees are using their health care benefits. Because the monthly fee for level funded plans is based on health care utilization, having this information can help an employer control future plan costs while also maximizing the potential for a refund for the current coverage period. Employers can pinpoint problematic areas (for example, employees are going to the emergency room instead of urgent care for minor injuries) and educate employees on better ways to use their health care benefits.

Disadvantages of Level Funding

While level funding has its advantages, there are also some possible disadvantages employers should consider.

Company Risk Pool

In most cases, the monthly cost for a level funded plan will vary based on how the employer’s own employee group uses health care. If a company’s workforce is generally young and healthy and doesn’t incur high-cost claims, the employer could see significant savings with a level funded plan. However, if the employee group is older, has chronic conditions (for example, cancer, diabetes or arthritis) or takes expensive medications, a level funded plan could be costlier than a fully insured plan.

Greater Compliance Burden

Moving from a fully insured health plan to a level funded one will trigger additional compliance requirements for an employer. Employers may need to redesign their health plan’s eligibility or benefit rules to comply with federal requirements prohibiting discrimination in favor of highly compensated employees. Employers with level funded plans also need to pay annual PCORI fees, comply with the ACA’s health coverage reporting requirements each year and implement HIPAA policies and procedures.

Contract Terms

Each carrier or TPA offering level funding will have its own contract terms, such as rules regarding how any claims surplus will be used or refunded. Because level funding is a newer concept, the contract terms may be unfamiliar to most employers. Employers who are interested in level funding should review these contracts carefully to understand the rules that will apply to them before signing the contract or communicating the plan’s terms to employees.

Some contract terms may not be business-friendly, and with larger carriers or TPAs, the terms may not be open to negotiation or customization. Keep in mind that employers will want to select the level funding vendor that offers them the best terms, which may not be their current carrier for fully insured benefits.

Also, note that most carriers and TPAs restrict their level funding plans to employers with a certain minimum and a maximum number of employees. These limits can differ for each carrier and TPA and can restrict an employer’s ability to contract with its desired vendor.

Determining if Level Funding Is Right for Your Workplace

Level funding may be right for employers who want more control of their plan’s design and access to utilization data while still paying a steady premium each month. Employers who understand their employee demographics and emphasize health care education may save money with a level funded plan.

When deciding if level funding is right for your organization, ask the following key questions:

- Are you a small or midsized employer?

Most carriers and TPAs only offer level funded plans to small and midsized employers, with different parameters for minimum and maximum employee counts. Before seriously considering level funding as an option, make sure your company falls within the specified employee range for level funding providers.

Most carriers and TPAs only offer level funded plans to small and midsized employers, with different parameters for minimum and maximum employee counts. Before seriously considering level funding as an option, make sure your company falls within the specified employee range for level funding providers. - Are your employees healthy and at a low risk of serious health conditions

The monthly cost for a level funded plan is based, in part, on the claims risk for the employer’s employee group. Determining facts about your workforce—such as whether your employees are mostly young or old, whether the majority of claims were due to chronic illnesses or one-time incidents, and the total dollar amount of claims—will help you determine if level funding makes financial sense for your company.

The monthly cost for a level funded plan is based, in part, on the claims risk for the employer’s employee group. Determining facts about your workforce—such as whether your employees are mostly young or old, whether the majority of claims were due to chronic illnesses or one-time incidents, and the total dollar amount of claims—will help you determine if level funding makes financial sense for your company. - What is your risk tolerance and cash flow situation?

A key reason for choosing a level funded plan over a self-insured plan is that, with a level funded plan, an employer pays the same amount every month regardless of claims activity. This predictability appeals to many employers, especially small employers and those without steady cash flow or significant cash reserves. However, if your company has a strong cash flow or reserve and feels comfortable taking on more risk, a self-insured plan may be the better option.

A key reason for choosing a level funded plan over a self-insured plan is that, with a level funded plan, an employer pays the same amount every month regardless of claims activity. This predictability appeals to many employers, especially small employers and those without steady cash flow or significant cash reserves. However, if your company has a strong cash flow or reserve and feels comfortable taking on more risk, a self-insured plan may be the better option. - Are you willing to review utilization data and educate employees about using health care?

To maximize cost savings, employers with level funded plans should periodically review utilization data provided by the carrier or TPA to identify and address any problems with how employees are using their benefits. If your company has the resources and ability to take these steps, it can help you save on health care costs.

To maximize cost savings, employers with level funded plans should periodically review utilization data provided by the carrier or TPA to identify and address any problems with how employees are using their benefits. If your company has the resources and ability to take these steps, it can help you save on health care costs. - Have you carefully reviewed the contract?

Before signing a level funding agreement, employers should carefully review the contract terms, many of which may be unfamiliar. For example, employers may be unfamiliar with the different options for using any claims surplus. You should work with your advisors to understand any unfamiliar terms and compare vendors, if possible, to find the best arrangement.

Before signing a level funding agreement, employers should carefully review the contract terms, many of which may be unfamiliar. For example, employers may be unfamiliar with the different options for using any claims surplus. You should work with your advisors to understand any unfamiliar terms and compare vendors, if possible, to find the best arrangement. - What are your coverage goals?

Decide on such factors as eligibility, benefit coverage, exclusions and cost sharing. Keep in mind that level funded plans are subject to nondiscrimination requirements under federal law, so your health plan’s rules cannot discriminate in favor of highly compensated employees.

Decide on such factors as eligibility, benefit coverage, exclusions and cost sharing. Keep in mind that level funded plans are subject to nondiscrimination requirements under federal law, so your health plan’s rules cannot discriminate in favor of highly compensated employees.

Conclusion

Level funding can provide many advantages to small and midsized employers. It can provide the stability and predictability of a fully insured health plan while offering the cost savings, flexibility in plan design and useful claims data that is available under a self-insured plan.

However, employers must consider a number of different factors before deciding if level funding is the right choice for them. These factors include:

- The employer’s size

- The health of the employer’s workforce

- The employer’s risk tolerance and cash flow

- The employer’s ability to review claims data and provide employee education, if needed

In addition, employers should carefully review contract terms before signing a level funded agreement, as level funding is a relatively new concept and employers may be unfamiliar with key aspects of the arrangement. The most important step to ensure a company makes the best choice is to have an experienced professional aid in the decision-making process. A TechServe Alliance representative has experience with level funding and can answer questions and assist with the decision.

TechServe Alliance welcomes the opportunity to help your organization examine its plan designs and make recommendations for improvement.

Appendix

The resources included in this section are for employers to print and use as they see fit. Speak with TechServe Alliance if you have any questions about these resources.

Note that some of the content may require customization.

Printing Help

There are many printable resources in this appendix. Please follow the instructions below if you need help printing individual pages.

- Choose the “Print” option from the “File” menu.

- Under the “Settings” option, click on the arrow next to “Print All Pages” to access the drop-down menu. Select “Custom Print” and enter the page number range you want to print, or enter the page number range you would like to print in the “Pages” box.

- Click “Print.” For more information, please visit the Microsoft Word printing support page.

Level Funding Evaluation

Level funded health plans are typically offered by insurance carriers and TPAs to small and midsized employers, as defined by the specific carrier or TPA. These plans combine the cost savings and flexibility of a self-insured health plan with the financial predictability of a fully insured health plan. This approach often appeals to employers who want to lower their monthly premium expenses but are hesitant to move to a self-insured plan.

It’s important to remember that level funding may not be a good fit for every company. However, it is worth asking TechServe Alliance about level funding options that may save you money on health care expenses.

Instructions

Answer the following questions to determine if your company is a good candidate to move from a fully insured health plan to level funding.

Questions

- How many employees does your company have?

- What is the average age of your employees?

- How would you rate the overall health of your employee population (including covered dependents)? Are you aware of any chronic health conditions?

Yes/no questions start here:

- Do you think your company is paying too much in monthly health care premiums (taking into consideration how your employees use their health care benefits)?

- Is your company hesitant to assume additional liability and risk for paying health claims?

- Do you want increased flexibility in plan design?

- Do you want better access to utilization information?

- Do you have the resources to review utilization data and provide targeted employee education if needed?

- If your current health plan design favors highly compensated employees, would you be willing to make changes to comply with federal nondiscrimination requirements?

- Are you willing to take on more compliance responsibilities, such as ACA reporting and PCORI fees?

If you answered “yes” to many of these questions, your company may benefit from level funding. Return this evaluation to TechServe Alliance to start a conversation about implementing a level funded health plan at your company.

Key Questions for Level Funding Contract Review

Each carrier or TPA offering level funding will have their own contract terms, such as rules regarding how any claims surplus will be used or refunded. Because level funding is a newer concept, the contract terms may be unfamiliar to many employers. Employers who are interested in level funding should work with their advisors to understand the agreement before signing the contract or communicating the plan’s terms to employees. Your TechServe Alliance representative has experience with level funding and can help you with this process.

Is Level Funding Right For You?

If you desire the freedom of a self-funded insurance plan but need a little more certainty for your budgeting concerns, level funding might be an option for you.

What is level funding?

Level funding is an option that can accompany a self-funded plan, aiding employers in their health coverage budgeting efforts. With level funding, employers pay a set amount each month to a carrier. This amount typically includes the cost of administrative and other fees and the maximum amount of expected claims based on underwriting projections, as well as embedded stop-loss insurance.

Pros

- No community premiums

You only pay the claims, stop-loss insurance and admin costs you incur. Stop-loss insurance can protect against large claims. - No lost money

You’ll get any leftover money back if low claims lead to a fund surplus. - Better utilization reporting

You can better pinpoint potential areas where employees could use more education to make wiser health care decisions.

Cons

- Potential for higher administrative fees

You pay more than just the cost of claims. - Out-of-pocket claims costs

Consider the worst-case scenario of a high volume of claims. - Contractual impact

You’ll need an experienced expert to guide you through this plan type, as different businesses have different needs.

Want to learn more?

We’re here to help you make the best decision for your company and its strategic goals. Contact TechServe Alliance for more information about coverage options.