IT Staffing Projected to Grow 5-7% in 2023

The IT & Engineering Staffing sectors will be among the most resilient staffing sectors in 2023

Despite news of tech layoffs and fear of recession, the technology staffing industry will be among the most resilient sectors in 2023 and will continue to grow. That was the key takeaway from the most recent TechServe Alliance State of the Industry webinar, presented by Mark Roberts, CEO of TechServe Alliance, and Jim Janesky, Principal, Forest Hills Advisory LLC.

Below are some of the highlights from the webinar:

Growth projection

Industry growth were extraordinarily strong in 2021 and 2022 which posted double-digit growth. While we don’t anticipate seeing that level of growth in 2023, TechServe projects that IT staffing industry will grow 5%-7% in 2023. Engineering staffing is projected to be up 3%-5% in 2023.

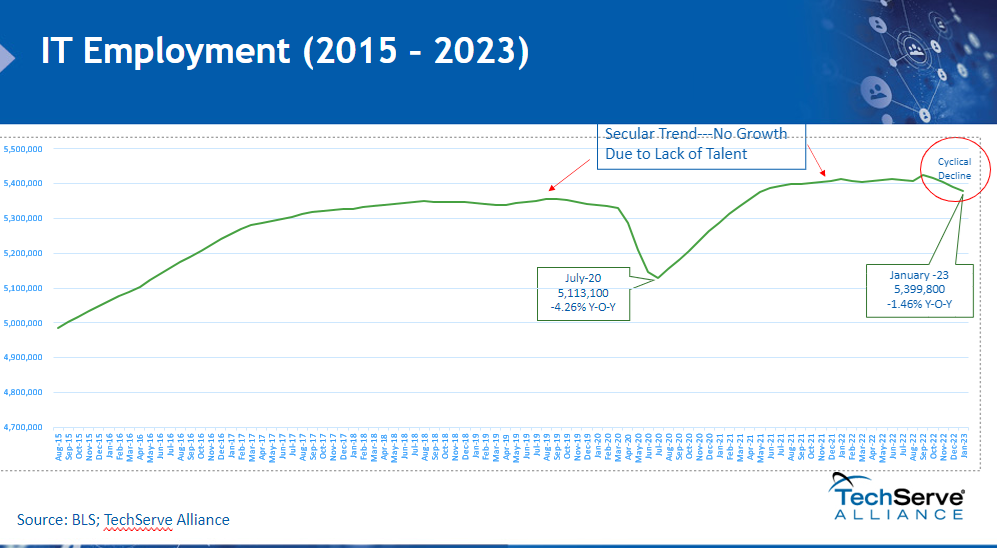

IT Employment and IT Unemployment Rate: Dueling Market Forces

While IT employment has trended down modestly over the past few months, the long-term picture is still the same: growth has been limited by the availability of technology professionals. While the overall unemployment rate of 3.4% is at a 50-year low and there are 1.9 open jobs for every job seeker, the data for IT and engineering is even more striking. In Q4 2022, IT unemployment was at a mere 2.1%, with a 2.2% unemployment rate in engineering. While Roberts and Janesky agree with the consensus of economists who project a relatively brief and mild recession beginning in the second half of the year, technology staffing will be more resilient (though not immune) to a macroeconomic downturn. It will also be poised to come ‘roaring’ back as we emerge from any economic slowdown.

Softening Demand for Direct Hire

With a pervasive fear of recession reinforced with news of tech giants laying off large numbers of employees (due to over hiring following the pandemic), companies are more cautious about adding to direct headcount. For IT staffing firms, this has manifested in the form of a pullback in demand for direct hire services.

While IT Hiring Varies Considerably By Region, Industry and Company, There is Still a Shortage of IT Talent

The IT employment picture is not monolithic. While some regions and client industries are pulling back, other areas continue to actively add to their IT headcount. Despite the layoffs in large Silicon Valley Tech Companies that make the headlines, demand for IT professionals remains strong in other regions and industries. Even within industries, the fortunes of individual companies and their appetite for hiring can range widely. While many will over generalize from a modest retrenchment in some high-profile companies (whose IT headcount is still way above pre-pandemic levels), a 2.1% unemployment rate in IT occupations reflects the perennial shortage of IT talent has not abated.

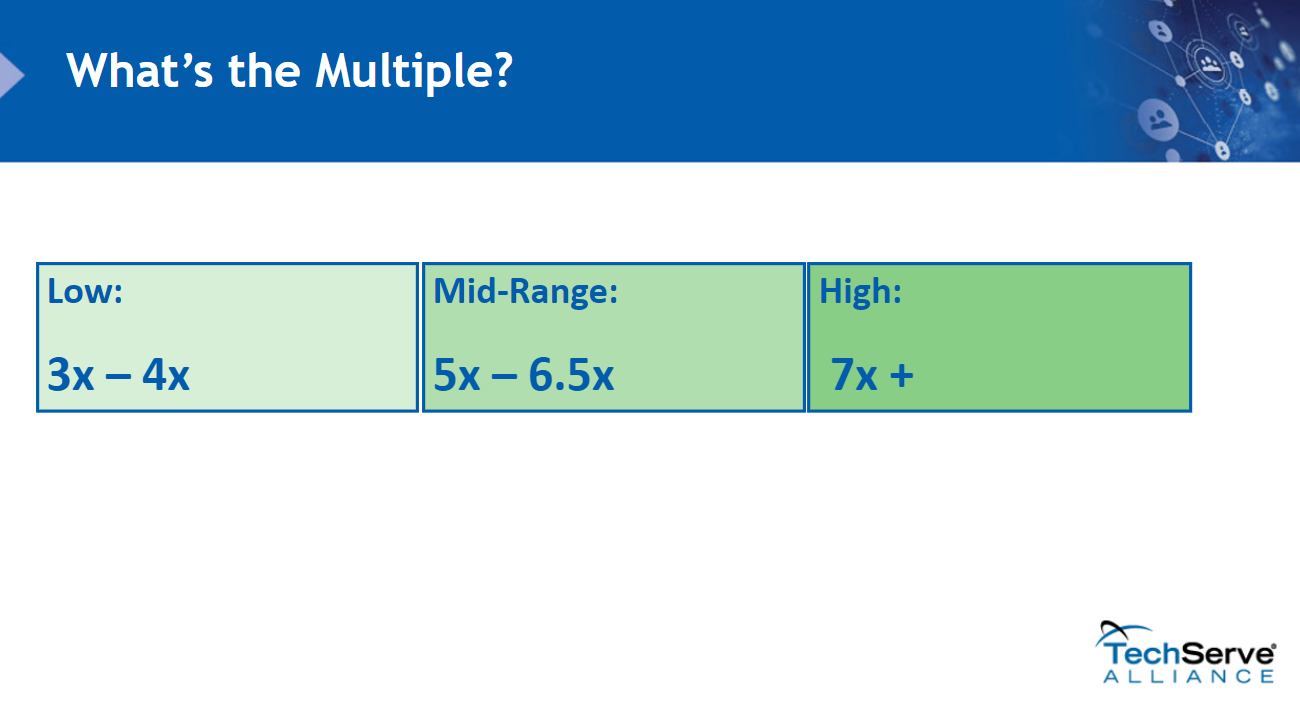

The M&A Market for Technology Staffing Companies Remains Strong

With both strategic buyers and private equity backed IT and engineering staffing firms active in the marketplace, demand for companies that meet revenue, client diversification, gross margin, operating margin and EBITDA thresholds remains strong. Within the TechServe Alliance M&A Marketplace Program, this high-level of interest has translated into strong multiples and valuations for these firms.

The Optimistic Takeaway

Both Roberts and Janesky are very bullish about the resiliency and future growth prospects of the industry.

As Janesky underscored during Q&A, “we’re projecting that the industry is going to grow 5% to 7% and leaning toward the upper end.”

On whether it was time to pullback or invest in the team, Roberts offered: “the companies that fare best are those that have invested in their team in all markets”

TechServe Alliance members can access the full State of the Industry webinar and additional data and insights. Not a member? Contact us today.