Factors to Consider When Choosing a Health and Benefits Partner

Employees are, without question, the most important asset to any company. In today’s tight talent market, it’s critical for companies, including technology staffing and solutions firms, to offer competitive compensation to attract and retain employees. In addition to the salary, benefits offered by a company are an important component of this compensation package. It is also most likely the single largest budget line item for a company after payroll.

According to the TechServe Operating Practices Report (OPR), the typical technology staffing firm spends an average of $218,000 per year on employee benefits ($84,000 is on medical, dental, life, and disability). No doubt then when paying for these insurance costs, you want to have confidence that your money is well spent and that your insurance broker is a trusted partner who is looking out for you and your employees.

Why Selecting the Right Benefits Partner Matters

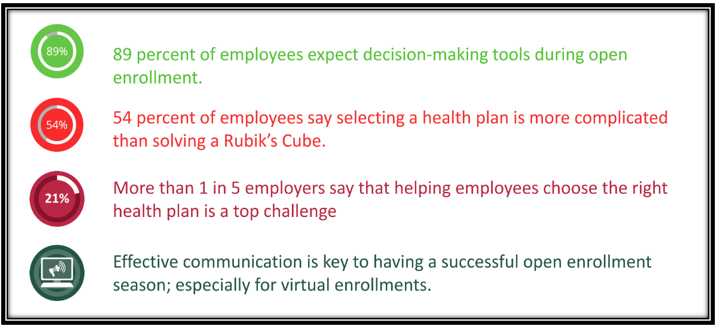

Having a great benefits program has a significant impact on employee satisfaction and retention. However, the complexity of most benefits plans is a source of confusion for employees, both at the time of onboarding and during open enrollment. Employees realize these are complicated choices and they expect tools to help them make these important decisions.

Taking into account the unique challenges faced by technology staffing and solutions firms, below are some factors to keep in mind when selecting the right broker partner and working effectively with them.

What to Expect from Your Benefits Partner

No matter the size of your company, it’s reasonable – given the premium costs – to expect a high level of service from your broker. “If you only hear from your broker once a year, that’s bad,” said Tommy Poulin, Health & Benefits Advisor for the TechServe Alliance program. “They should never just be presenting the renewal; they should be presenting the options they researched in the market.”

In general, there are four primary areas of support that a company should expect from a full-service broker:

- ● HR support

The people responsible for Human Resources in a staffing firm often wear many hats and need all the support they can get. A good broker should offer technology tools that help make the job easier; automating functions that otherwise would be manual (vacation tracking, online enrollment, decision support, and more). In addition to taking some of the burden from HR, this also improves the onboarding for new employees, said Michele Clarke, CFO & COO of TechServe Alliance.“The technology creates a better experience for the new consultants you’re bringing on,” Clarke points out. “It’s the employee experience: how are you different and better than other staffing firms?” - ●Employee engagement

Many employers say that helping employees choose the right health plan is one of their top challenges. But employers aren’t always the best at communicating about plan options. That’s where an effective broker partner should step in; communicating regularly with employees about their choices and helping them make the right decisions for them. - ●Plan and Claims Analysis

Any business leader, especially in the technology sector, knows that the best decisions are driven by data. The right broker partner should have the technology to provide you with the data you need and industry information, to make better decisions, said Brian Drummond, CEO of Kasa, a cloud-based platform and a digital insurance agency. Knowing what other companies in your sector offer gives you important data on your competitive position, he added. - ●Compliance Support

Regulatory compliance related to employee health plans is complicated, especially if a firm operates in multiple states, as many technology staffing firms do. From The Affordable Care Act (ACA) and DOL Department of Labor (DOL) compliance to 6055/6056 reporting, to 1094/1095 filing, there is a lot of required filing and legalities. A good benefits partner will ensure your firm is compliant with all legislation and maintain compliance as regulations change, and your business grows.“For example, your broker should be able to alert you to the fact that you’ve got 47 employees now,” Drummond said. “When you reach 50, there are some new compliance requirements, and the broker should come up with solutions for you.”

Considering Changing Your Broker?

If you’re considering making a change in brokers, timing is everything. The right time, Drummond stresses, is not right before your renewal.

The process itself takes time; It can be accomplished in as few as seven to ten days for a small company and up to several weeks for larger plans with more members. Industry experts recommend beginning the process a minimum of 90 days prior to the next renewal date. This will give you the time to fully evaluate all your options. Most importantly, it uncouples the decision from the renewal of your current plan, which should be considered separately.

“Doing so allows you to avoid the ‘paralysis by analysis’ that can result from too many choices and too little time to make them,” Poulin added.

Questions to Ask a Prospective Broker Partner

For any company, in any industry, it is a significant decision to begin working with a new broker partner. In the technology staffing sector, there are some unique complexities, which make it important to address them upfront. Drummond recommends asking the following three questions to any prospective broker that you are interviewing to evaluate their understanding of the staffing industry:

- ●How many multi-state clients do you have?

Why it matters: As noted earlier, regulatory compliance is complicated and absolutely essential. Health insurance is regulated at the state level. Therefore, compliance requirements are different across state lines. Given the changing nature of the working world, most technology staffing firms have (or will have) clients and consultants, and employees, working in multiple states. It’s critical, therefore, to have a broker who understands how to keep your business compliant, no matter where it is located. - ●How many staffing firm clients do you have?

Why it matters: The staffing industry is unique in many respects. For example, many firms want different benefits for consultants versus permanent staff. A broker familiar with the staffing sector can help structure a plan with options tailored to different job categories. A broker who knows the sector will also be familiar with the exceptionally high frequency of on/offboarding that is unique to staffing. - ●What technology is included?

Why it matters: A great deal of administration is involved in on/offboarding employees. This happens more often in staffing firms. “The instances of onboarding and offboarding in staffing, compared to other industries, is ten times or more,” Drummond estimates. Automation can help remove this administration burden from HR.

Choosing the right employee benefits plan is a critical business decision. A vital step in this decision is partnering with the right benefits partner, who is familiar with the staffing sector and should be able to offer technology that saves time, eliminates redundant data entry, and, perhaps most importantly, minimizes the risk of human error.

For more information, watch the webinar on Selecting an Employee Benefits Partner for Your Technology Staffing Firm.