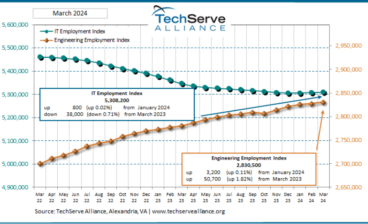

Alexandria VA, April 9, 2024 – IT employment ticked up 0.02%, adding 800 jobs in March, according to TechServe Alliance, the national trade association for...

READ MORE >

Date: Thursday, May 9th, 2024 Time: 12:30 PM – 1:30 PM ET Speaker: Ben Hunter, Principal, UHY LLP, Certified Public Accountants In the fast-evolving...

READ MORE >

Date: Tuesday, May 14th, 2024 Time: 12:30 PM – 1:30 PM ET Speakers: Kip Wright, Chairman, INSPYR Solutions Kelly Boykin, Founder, Growth Curve Advisory ...

READ MORE >

By Daniel Fox, Marketing Manager at Mercury In an era where technology moves at phenomenal paces and increasingly intersects with every layer of business, recruiters...

READ MORE >

Spotlight on Mirtes Lobaito Founder and CEO, AGM Tech Solutions Inc5000 2023/2022 #38 TOP CEO 2021 Glassdoor A WBENC and MBE certified Mirtes Lobaito is...

READ MORE >

Spotlight on Crystal Peterson CEO/President, STG Consulting TechServe Member Since 2011 Therapist, Agile leader Women-owned tech staffing firm (Trustee Camille Cornaby) Crystal Peterson has worn...

READ MORE >

On April 1, 2024, USCIS issued several alerts about the H-1B visa program: H-1B Initial Electronic Registration Selection Process Completed USCIS announced the agency received...

READ MORE >

By: Jerry Grady, Partner & National Staffing Practice Leader, UHY Advisors MI, Inc. The SECURE 2.0 Act is aimed to help taxpayers bolster their retirement...

READ MORE >

The dialogue around IT employment and economic indicators continues to reflect a complex landscape and narrative. Despite challenges, such as ongoing layoffs within tech companies...

READ MORE >Please contact us at (703) 838-2050 or at